Entresto’s Medicare negotiated price is a head scratcher

Our Center for Pharmacoeconomics (CPE) Exclusive suggests that Entresto’s US market-based price is less than the benefit it provides.

TURN THE PAGE

In the CPE Exclusive we released last week, we presented estimates of the cost-effectiveness of Entresto® (sacubitril/valsartan, developed by Novartis Pharmaceuticals Corporation). Entresto was approved in 2015 for heart failure. Upon launch, the manufacturer priced a year’s worth of treatment at around $4,500 (in 2015 US dollars).

Our conventional cost-effectiveness analysis from the health system perspective suggests that sacubitril/valsartan is cost-effective even when assuming the launch price stays constant forever (which it won’t). Entresto could be priced between $11,000 and $17,000 per year before meeting commonly used thresholds for cost-effectiveness. The US market secured an even better deal for Entresto.

Despite this, downward pressures to the price of Entresto are coming—whether due to the Medicare Drug Price Negotiation Program price going into effect in 2026 or due to the expected loss of exclusivity and subsequent entrants of generic equivalents in as early as a few months. Incorporating these price changes suggested that sacubitril/valsartan was even more cost-effective than initially modeled.

The figure below reports the cost-effectiveness estimates for different cohorts that started treatment during each year that sacubitril/valsartan has been in the market. The cost-effectiveness continues to improve for cohorts that started sacubitril/valsartan after its launch year due to a higher proportion of time spent on sacubitril/valsartan after its modeled exclusivity period.

Source: Leerink Center for Pharmacoeconomics (CPE) sacubitril/valsartan model.

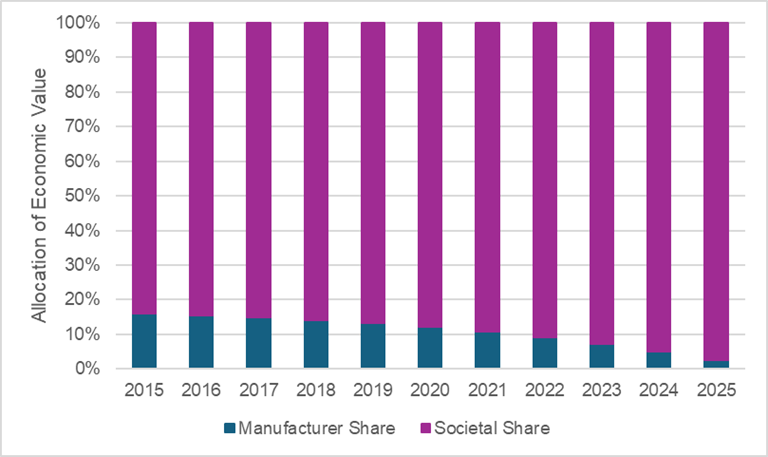

Considering the allocation of sacubitril/valsartan’s value between the manufacturer and society, society is expected to receive the majority share of the value. The figure below plots the expected allocation of value between the manufacturer and society based on the year treatment was started. Importantly, we only considered economic value from health system cost savings, survival gains, and quality of life improvements thus we are likely underestimating the value accrued to society that is downstream of productivity gains, reduced caregiver time, etc.

Source: Leerink Center for Pharmacoeconomics (CPE) sacubitril/valsartan model.

Assuming a threshold of $150,000 per health outcome gained (i.e., a commonly used threshold for cost-effectiveness analysis), the manufacturer is expected to receive a minority share of the economic value of sacubitril/valsartan. This allocation of value to the manufacturer steadily declines over the modeled exclusivity period. Conversely, the expected allocation of value to society continues to increase over time.

Read our full report-to understand the model inputs and assumptions that informed our analysis.

WE DID IT AGAIN

In our Exclusive, we did not conduct a full generalized cost-effectiveness analysis (GCEA) and are thus underestimating the societal value of sacubitril/valsartan. Our CPE Exclusives are not conducted to pass a value determination or to suggest a price for a drug. Rather they are conducted to explore what you might have to believe to find the US market-based price “worth it”.

In the case of sacubitril/valsartan, it does not need to result in any societal spillovers (e.g., productivity gains, caregiver time reductions, risk reduction, etc.) to see that the price is more than “worth it”.

However, for the purposes of this newsletter, I used the No Patient Left Behind GCEA Calculator (freely available on their website) to adapt our traditional CEA (TCEA) into a GCEA. As reported in our CPE Exclusive, the TCEA estimate for sacubitril/valsartan (not assuming any societal impacts or price changes after launch) was around $27,000 per equal value-life year.

Using the GCEA Calculator, and making some conversative assumptions around productivity, caregiver impact, and risk reduction, the GCEA estimate for sacubitril/valsartan was around $4,000 per generalized risk-adjusted quality-adjusted life year gained.

The figure below plots the TCEA estimate at the bottom and the GCEA estimate at the top. The biggest driver of value in the GCEA was the inclusion of price dynamics.

Source: No Patient Left Behind GCEA Calculator.

SO WHAT

Entresto was selected as one of the first drugs to be negotiated as part of the Medicare Negotiation Program. The Medicare negotiated price is a 53% discount off the 2023 list price and an approximate 36% discount off the net price. So what? Our conventional cost-effectiveness analysis suggested that Entresto’s price was already far less than the value of the drug provided to patients and to society, yet it still landed on the list with a 36% discount off its net price. An efficient system should reward valuable innovation, not impose price controls on high-value ones.

In a recent op-ed, Dr. Darius Lakdawalla states, “Paying less for drugs that matter most to patients will stifle innovation in valuable areas. Blunt reductions in the prices of all drugs, no matter their value, will deprive future generations of medical breakthroughs that are their due.” He suggests a floor price based on the value of a drug to patients would protect valuable innovation. I agree. If a floor price defined by its value to patients was calculated for Entresto, it likely would have shown that the market-based price for Entresto was already less than the calculated floor price.

On a different note, the Medicare negotiated price for Entresto goes into effect January 1, 2026. However a key patent for Entresto is set to expire mid-2025 and numerous generic versions have already “scored FDA nods for their copycats”. If a generic is marketed before the end of March 2026 (which seems quite likely), Entresto will be removed from the 2027 Medicare negotiated price list. So what? The Medicare Negotiated Program is extremely costly to implement. It is expected to cost $2.9 billion over fiscal years 2022-2033. That’s just on the Medicare side. I’m sure the drug manufacturers (and other key stakeholders) are also having to spend a huge amount of money to prepare and participate in the process. For Entresto, it doesn’t seem like that resource spend is going to be “worth it”. Generic versions are entering the market soon, which will likely result in the removal of Entresto from the Medicare price list. This of course doesn’t remove the resources already spent by the government and manufacturer to negotiate a price for Entresto—a price that is likely higher and much shorter-lived than a market-based price with generic competition.

One final note. Once generics enter the market for an oral drug, the price should drop off a cliff quickly. Based on previous analyses of oral drugs, once generics enter the market, the price drops 74% within 8 months. We should expect the same for Entresto. Thus, market competition will likely reduce the price for sacubitril/valsartan far more effectively (and efficiently). If the Medicare Negotiation Program is intended to reduce spending, then the selection of Entresto is a head scratcher.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.