In case you needed more evidence that a drug’s price falls off a cliff

ENTER STARJEMZA®

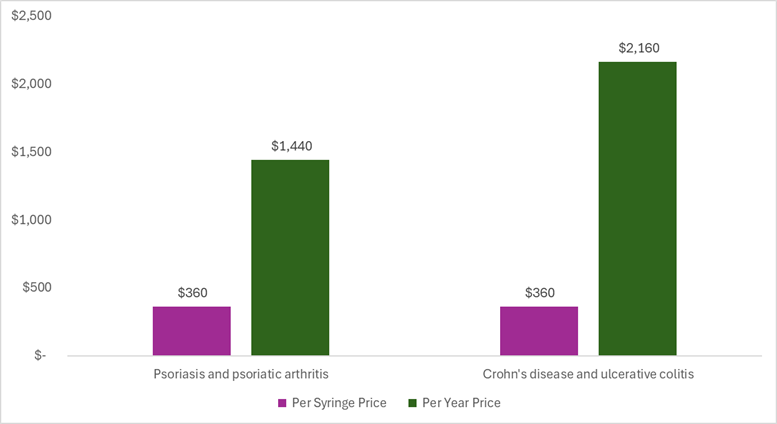

A biosimilar to Stelara® (ustekinumab) enters the market priced less than $2,000 per year. Starjemza (ustekinumab-hmny) is a biosimilar version of Stelara that hit the shelves of the Mark Cuban Cost Plus Drug Company this week at a price of $360 per syringe (including the manufacturing price, markup, and pharmacy labor). This equates to around $1,400 per year when used for psoriasis or psoriatic arthritis and around $2,200 per year when used for Crohn’s disease or ulcerative colitis.

The per syringe price includes the manufacturing price, 15% markup, and pharmacy labor. The per year prices are calculated for the maintenance schedule. For doses that vary by weight, we assumed a standard weight of 75 kg. Thus for the psoriasis and psoriatic arthritis calculation, we used 45mg every 12 weeks and for the Crohn’s disease and ulcerative colitis calculation, we used 90mg every 8 weeks. The per syringe price of Starjemza is the same for the two different strengths (45 mg and 90 mg), but the number of syringes used per year varies by the indication.

How does this biosimilar price compare to the price of the originator and other biosimilars? In a piece by Ed Silverman and Elaine Chen, they note a list price for the Stelara originator product of around $29,000 per syringe for the 90mg strength and “other biosimilars with list prices ranging from $15,000 to $60,000” per year.

What does this biosimilar price mean for health system efficiency? This is what really excites me. The health system value of ustekinumab has previously been estimated as $10,000 per person per year for psoriasis and $16,000 per person per year for ulcerative colitis (estimates have been adjusted to 2025 US dollars and an average was calculated for biologic experienced vs. biologic naïve where estimates were available). That means at a biosimilar price of around $2,000 per person per year, there is substantial health system surplus by way of cost avoidance and improved patient health outcomes. We are talking about thousands of dollars of net monetary benefit per person treated per year. For a system that needs to find efficiencies, this is huge.

I provide these estimates not to suggest that biosimilars should be priced based on their value. Ideally the long-term stable price of biosimilars can get close to their marginal cost of production. I am also not suggesting that all of the health system value was quantified in the estimates cited above. Not everything that counts can be counted and different assumptions could generate different results. This is not to suggest that only health system impacts should be considered. Innovation can result in meaningful impacts on patient productivity, caregiver burden, and many other societal level factors. I provide these estimates to show that healthcare innovation can produce meaningful benefits for the health system—benefits that can occur long after the market exclusivity period has ended.

We can incentivize innovation over the market exclusivity period and reap societal returns long after.

SO WHAT

Stelara is a biologic that was initially FDA approved in September 2009 for moderate to severe psoriasis. Over the market exclusivity period, the manufacturer invested in post-approval research and successfully received six supplemental approvals including additional indications for active psoriatic arthritis, moderately to severely active Crohn’s disease, adolescents with moderate to severe plaque psoriasis, adults with moderately to severely active ulcerative colitis, pediatric patients with moderate to severe plaque psoriasis, and pediatric patients with active psoriatic arthritis.

As recent as last week, the manufacturer submitted a supplemental Biologics License Application to expand the approval to “children two years and older with moderately to severely active ulcerative colitis” based on a recently completed clinical trial in that population. The manufacturer was incentivized to invest in post-approval research and pursue additional indications, and society gets to benefit from this research and knowledge long after the market exclusivity period.

As recent as last week, the manufacturer submitted a supplemental Biologics License Application to expand the approval to “children two years and older with moderately to severely active ulcerative colitis” based on a recently completed clinical trial in that population. The manufacturer was incentivized to invest in post-approval research and pursue additional indications, and society gets to benefit from this research and knowledge long after the market exclusivity period.

As compared to small molecule generics, we have less real-world data on the post-loss of exclusivity pricing for biologics/biosimilars simply because of the relative “newness” of biosimilars. We are still figuring out if and how biosimilars can produce rapid and steep declines in price after the exclusivity period ends for the originator.

However when we look at Stelara as a case study, the first biosimilar entered the US market in January 2025 which means Stelara’s market exclusivity period ended after 15 years. Multiple other Stelara biosimilars have rapidly entered the US market as biosimilar manufacturers are hungry to capture market share. A biosimilar is now on the market for 98% less than the list price of the originator. These are all promising indicators. We incentivized and rewarded novel innovation over the market exclusivity period, and now competition has dropped prices to generate societal returns in perpetuity.

This is exactly what the system is intended to do. The biopharmaceutical market is uniquely characterized by patent protection periods that provide the inventors of the drug a period of time to generate the return on their investment. But after that period, copycats can enter and this competition needs to result in substantial price drops to free up money to pay for new innovation.

Is the system perfect? No.

Are drugs special because they drop in price over time? Yes.

Can competition dramatically drop a drug’s price over time? Yes.

Is transparency helpful in understanding a drug’s price? Yes.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.