Generic Entresto enters at a 90% price discount

CRASH COURSE

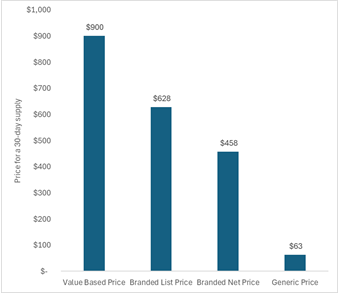

Generic Entresto® (sacubitril-valsartan) enters the market at a 90% discount. Last week, a generic version of Entresto hit the shelves of the Mark Cuban Cost Plus Drug Company. A 30-day supply of sacubitril-valsartan is now only $62.50. That’s approximately $2 per day/$1 per pill for a treatment for heart failure. This is 90% less than the branded list price (2023 list price of $628 for a 30-day supply) and 86% less than estimates of its branded net price ($458 for a 30-day supply).

Entresto was the focus of our April CPE Exclusive. We estimated that Entresto could be priced between $900 and $1,400 for a 30-day supply before meeting commonly used cost-effectiveness thresholds. However, the US market secured an even better deal. The market-based price for Entresto was less than the threshold-based price even over the exclusivity period.

The figure below shows the price for a 30-day supply, with the first bar reflecting the lower estimate of a value-based price based on conventional cost-effectiveness analysis, the second bar reflecting the branded list price in 2023, the third bar reflecting the branded net price in 2023, and the fourth bar reflecting the current generic price at the Mark Cuban Cost Plus Drug Company.

In our April CPE Exclusive, I noted that downward pressures to the price of Entresto were coming with the expected loss of exclusivity in as little as a few months. Now three months later, I see a social media post from the Mark Cuban Cost Plus Drug Company announcing that generic Entresto is now available and the price has already fallen off a cliff. Importantly, we are only within the first weeks of generic entry. Competition is expected to continue to reduce the price even more over time.

A generic entering the market at a substantially lower price is not a miracle or a one-off event for Entresto. This is exactly what the system is set up to do. The biopharmaceutical market is uniquely characterized by patent protection periods that provide the inventors of the drug a period of time to generate the return on their investment. But after that period, copycats can enter and this competition can result in substantial price drops.

SO WHAT

No one talks about generics entering the market. We talk about when a new drug is first approved, which is often coupled with criticisms around its high launch price. However, we rarely see coverage when the first generic enters the market and results in a drug’s price substantially dropping overnight. This is the proverbial finish line. The allotted time the inventors had to seek a return on their investment has passed and now competition can enter to drop a drug’s price close to its cost of goods sold. Yet, we don’t celebrate at this finish line. We don’t thank the inventor of the drug for taking the risk and investing the capital to create this product that can now be cheap forever. If we are going to have a future that understands how the market works to reduce drug pricing and that a drug’s price is not high forever, we have to talk about this. Instead, we talk about a drug’s price over its exclusivity period—the period during which the drug’s price is intended to be high to generate a return and incentivize innovation.

I also want to acknowledge that Entresto was initially approved in 2015 and thus the exclusivity period was only ten years. It’s common to hear pharmaceutical companies be criticized for creating “patent thickets” and other types of anti-competitive behaviors that delay generic entry. You often don’t hear much when the inventor’s exclusivity period ends up being less than the average 13-14 years.

Although we rarely talk about it, we have a market design for pharmaceuticals that is set up to reduce prices over time. It can function very well to produce substantial price drops while maintaining incentives for innovation when we give it time to operate. Kirsten Axelsen and I have an op-ed out last week on how market competition has already worked to reduce prices of GLP-1s for obesity. Despite this, there is ongoing interest in government involvement in drug pricing with ongoing calls for Most Favored Nation pricing and the second round of negotiations for the Medicare Drug Price Negotiation Program well underway.

It seems like the market is going to work for Entresto. In situations where the market does not work as intended, that is where we need health policy. Entresto was selected as one of the first drugs to be negotiated as part of the Medicare Drug Price Negotiation Program (a generic version was not marketed at the time of selection). However, as generic versions enter the market, Entresto will likely be removed from the 2027 negotiated drug list. Entresto was selected before we knew if the market was going to work as intended or not. The market design is set up to expect generic/biosimilar competition around 13-14 years after approval. However, for small molecules, a drug can be selected for Medicare drug price negotiation 7 years after approval with negotiated prices setting in 9 years after approval. We do not know if the market is going to work as intended 7 or 9 years after approval. If the Medicare negotiation timetables were moved to after the timetables set up by the market, a drug for which the market did not work as intended might have been selected.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.