Generic competition for Xarelto results in a 90% price drop

ENTER RIVAROXABAN

Generic Xarelto® (rivaroxaban) entered the market and the price fell off a cliff. Rivaroxaban is commonly used for multiple conditions, one of which is to reduce the risk of heart attack, stroke, or cardiovascular death in adults with coronary artery disease. In March 2025, generic rivaroxaban 2.5mg tablets entered the market (currently only the 2.5mg tablets have generic versions available).

A 30-day supply of rivaroxaban is now only $36 at the Mark Cuban Cost Plus Drug Company. That’s around $1.20 per day/$0.60 per pill for one of the “most commonly prescribed medications in the United States”.

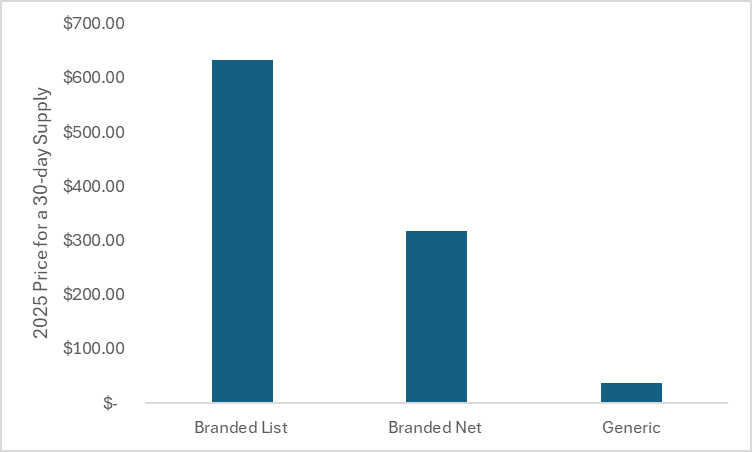

The generic price at the Mark Cuban Cost Plus Drug Company is 94% less than the 2025 branded list price of $634 for a 30-day supply and 88% less than our guess of its 2025 branded net price (assumed a net price of $317 for a 30-day supply based on a 50% list-to-net price discount calculated by comparing a publicly reported estimate of a net price to a publicly reported list price).

The figure below plots the price for a 30-day supply of rivaroxaban for the coronary artery disease indication. The first bar reflects the 2025 branded list price prior to generic entry, the second bar reflects the 2025 assumed branded net price prior to generic entry, and the third bar reflects the current generic price at the Mark Cuban Cost Plus Drug Company (as of September 25th, 2025).

A generic in the market at a substantially lower price is not a miracle or a one-off event for Xarelto. This is exactly what the system is set up to do. The biopharmaceutical market is uniquely characterized by patent protection periods that provide the inventors of the drug a period of time to generate the return on their investment. But after that period, copycats can enter and this market competition can result in substantial price drops.

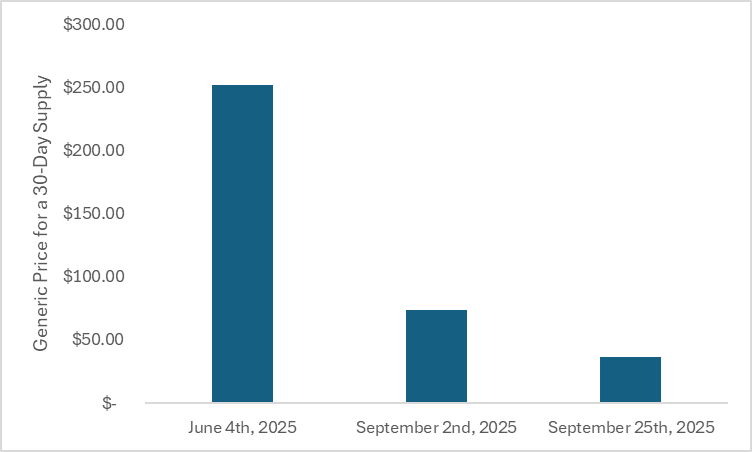

Importantly, generic competition has only been in the market for a few months. More competition and more time will likely drop prices even more. When I first looked at the 30-day generic price for rivaroxaban 2.5mg in June 2025 for our Drug Launch Superstars special report, the price was $252 for a 30-day supply at the Mark Cuban Cost Plus Drug Company. On September 2nd, the Mark Cuban Cost Plus Drug Company posted on social media that there was a 70% price drop for generic rivaroxaban 2.5mg. That reduced the price for a 30-day supply down to $74. By the time I got around to writing this, the price was down to $36 for a 30-day supply.

The figure below plots the price for a 30-day supply of generic 2.5mg rivaroxaban from the Mark Cuban Cost Plus Drug Company at different time points. The generic price has continued to rapidly drop over a short period of time.

I have said it before, but I am going to say it again. No one talks about generics entering the market. The allotted time the inventors had to seek a return on their investment has passed and now competition can enter to drop a drug’s price close to its cost of goods sold. If we are going to have a future that understands how the market works to reduce drug pricing and that a drug’s price is not high forever, we have to talk about this.

SO WHAT

Xarelto was first approved in July 2011 to prevent deep vein thrombosis in patients undergoing knee or hip replacement surgery. Since its initial market entry, it has received at least 6 supplemental approvals for additional indications and new dosing.

It wasn’t until 2018 when Xarelto received approval to reduce the risk of major cardiovascular events in patients with coronary artery disease. Xarelto had been in the market for seven years before it received approval for coronary artery disease. The market incentives were there for the inventor to invest in this post-approval research.

Additional indications are not only a win for the inventor of the drug. For payers, an additional indication can increase the number of drugs approved for a condition, which can result in more price competition.

And for society, additional indications usually have a shorter period of time that is under patent protection (i.e., when drug prices may be “high”) and thus a shorter time to generic entry (i.e., when drug prices should drop). We saw this with Xarelto and its coronary artery disease indication. It was approved for this indication in 2018 and generic versions entered in 2025. Therefore, we saw generic entry 7 years after the approval of this subsequent indication.

We note that Xarelto was selected in the first round of Medicare Drug Price Negotiation. Generic versions were not marketed at the time of selection.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.