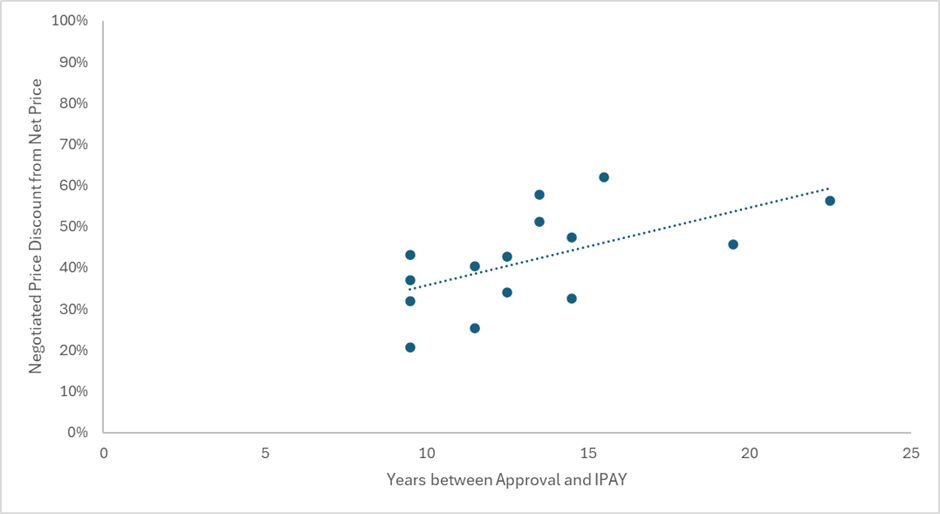

Are the Medicare negotiated price drops larger for drugs that have been on the market longer?

- Yesterday, CMS announced the negotiated prices for the 15 drugs with initial price applicability in year 2027.

- At the drug level, they report each negotiated price discount from the list price.

- Estimated rebates off the list price for the 15 drugs can be found in this paper by Sean Sullivan and colleagues.

- I applied the estimated rebates reported in the paper by Sean Sullivan and colleagues to the 2024 list prices reported by CMS to estimate how the Medicare negotiated price compared to the net price at each drug level.

- A simple average suggests the Medicare negotiated price is around 40% less than the estimated net price. This is comparable to the “44% lower net spending” estimated by CMS. This is higher than the 22% reduction in net spending that was observed for the first 10 drugs selected for negotiation with initial price applicability in year 2026. The Congressional Budget Office had previously assumed a net price reduction of around 50% on average.

- This average price reduction from the estimated net price is relatively similar when weighting by the number of enrollees on each drug or weighting by the annual sales of each drug.

- For the subset of drugs that will have been on the market for more than 14 years (typical market exclusivity period) before the initial price applicability in year 2027, the Medicare negotiated price is around 50% less than the estimated net price.

- There appears to be a small, positive relationship between the Medicare negotiated price discount from the net price and the years between approval and when the negotiated price sets in. The slope of the fitted line is around 2% per year, although a small sample is used and the years between approval and IPAY are rounded up to the nearest year.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2026 MEDACorp LLC. All Rights Reserved.