GLP-1s for obesity are priced less than the value they provide

CRASH COURSE

Paying for a GLP-1 as a treatment for obesity is a cost-effective investment. A recent generalized risk-adjusted cost-effectiveness analysis by Drs. Alison Sexton Ward and Dana Goldman estimated value-based prices (VBPs) for GLP-1s for obesity treatment.

They estimate an annual VBP of $12,202 to $16,765 for the average aged population. The VBP is associated with a range based on different assumptions around the long-term benefit of delaying or preventing diabetes.

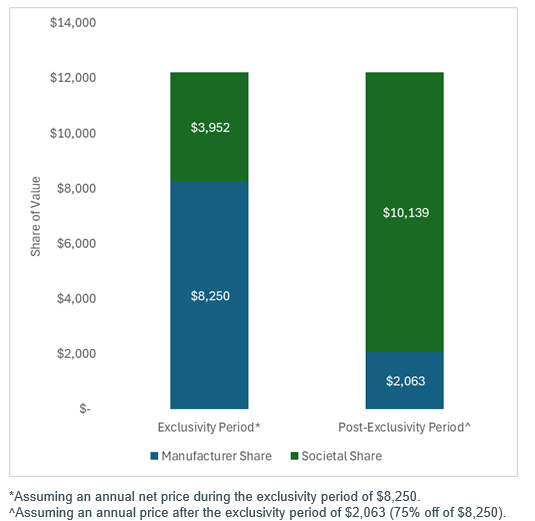

Recent estimates of net prices for GLP-1s for obesity range from $7,500 to $9,000 per year suggesting that these treatments are already priced less than the value they provide. At an annual net price of $8,250 (midpoint of $7,500 and $9,000) and a VBP range of $12,202 to $16,765, the manufacturers are only being rewarded for 49-68% of the drug’s value, leaving society to accrue the remaining 32-51%.

As the market and competition work to reduce prices over time, the share of the value that will accrue to society will increase over time. In the spirit of considering the full product lifecycle, let’s think about what future generic competition might do. A recent analysis of generic markets by the Assistant Secretary for Planning and Evaluation showed that in large markets there is an average of 10 generic competitors per drug and that prices “decline by 70% to 80% relative to the pre-generic entry price in markets of 10 or more competitors following 3 years after first generic entry”.

Let’s assume a price decline of 75% (midpoint of 70-80%) with generic competition. Assuming a pre-generic entry price of $8,250, a 75% price drop would result in an annual price of $2,063. At an annual price of $2,063, the societal share of the value is greater than 80% for the average aged population. Using the lower bound of the VBP range ($12,202 per year) and thus assuming the more conservative long-term treatment effectiveness estimate, we plot the annual allocation of aggregate value in the figure below. Given the estimated net price is already less than the estimated VBP, society is expected to accrue value even during the exclusivity period. The share of value that accrues to society is expected to increase over time as market dynamics and competition work to reduce prices.

Generic competition has dropped prices more than 75% for many other drugs and conditions and thus the 75% estimate could be conservative. The intent of this exercise is not to estimate the precise post-exclusivity price, but to show that prices change over time and thus so does the share of the value that accrues to society. If the price decline with generic competition is even greater, the value that will accrue to society will also be greater.

Importantly, it is challenging to incorporate all the benefits and risks of a treatment within a cost-effectiveness analysis and the evidence base for these treatments is continuing to grow. Also, there is no single or explicit cost-effectiveness threshold for decision making in the US. These factors should be considered when interpreting these findings.

SO WHAT

Society will only share in the value of these treatments if people are able to access these treatments and experience benefits. Insurance coverage for obesity treatments has remained low despite these innovations being priced beneath the value they provide. Two reasons include: 1) the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 excludes coverage of drugs for weight loss by Medicare Part D and 2) the large population that could potentially benefit from these treatments could result in a large budget impact for payers.

[Note: Budget impact is different from cost-effectiveness. A budget impact analysis is focused on short-term affordability (i.e., how might a new drug increase/decrease payer costs over the next few years) whereas a cost-effectiveness analysis is focused on long-term efficiency (i.e., how much does it cost to get one additional unit of a health outcome). A drug’s price can be cost-effective yet also produce a large budget impact.]

GLP-1s for obesity are only one example of an innovation that could provide huge long-term gains despite a short-term budget impact. Biopharmaceuticals must be seen as investments that have the potential to provide health system efficiencies and affordability over time. The need to think long-term—to consider long-term gains and to consider the market dynamics that exist to reduce a drug’s price over time—is relevant for all biopharmaceuticals. A drug’s price is typically “high” when it first enters the market. That high price generates the return on investment for the innovators and investors of the drug and incentivizes the development of new drugs.

However, the system is set up so that the price should only be high for a period of time. Generic/biosimilar competition can come in after a protected period of time to bring down a drug’s price. Branded competition during the exclusivity period can also reduce a drug’s price. These things require a system that can operate beyond short-term budgets.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.