The market-based price for Attruby is worth it

TURN THE PAGE

A Leerink Center for Pharmacoeconomics (CPE) Exclusive suggests that the market-based price for Attruby™ is less than the societal benefit it could provide even under conservative assumptions.

This marks the second CPE Exclusive we have released. CPE was launched with the goal of evaluating the societal impact of healthcare innovations, and we intend to release CPE Exclusives regularly to help explain the impact an innovation has on patients, caregivers, the health system, and society as a whole.

Our most recent CPE Exclusive evaluates the societal impact of Attruby. The U.S. Food and Drug Administration approved Attruby (acoramidis) on November 22nd, 2024. As compared to supportive care alone, Attruby is expected to reduce hospitalizations, increase survival, and slow the decline in functional status for people living with transthyretin amyloid cardiomyopathy (ATTR-CM). This has exciting implications for individuals living with ATTR-CM, their caregivers, and society. We anticipate Attruby will have a positive impact on 21 of 24 value elements.

We believe Attruby’s benefits will outweigh its cost over its time in the market if its price drops after the exclusivity period (which we think it will, see next paragraph) and if life extension is valued equally across all populations (which we think it should be, see next section).

We believe it is extremely likely that a substantial price drop will occur after the exclusivity period for multiple reasons: 1) the only other disease-modifying therapy for ATTR-CM has already received attention from generic manufacturers, 2) small molecules are typically easy to genericize and have observed substantial drops in price after their exclusivity period, and 3) the vast majority of the eligible population for Attruby is on Medicare and thus Attruby could be eligible for Medicare drug price negotiation even before its loss of exclusivity.

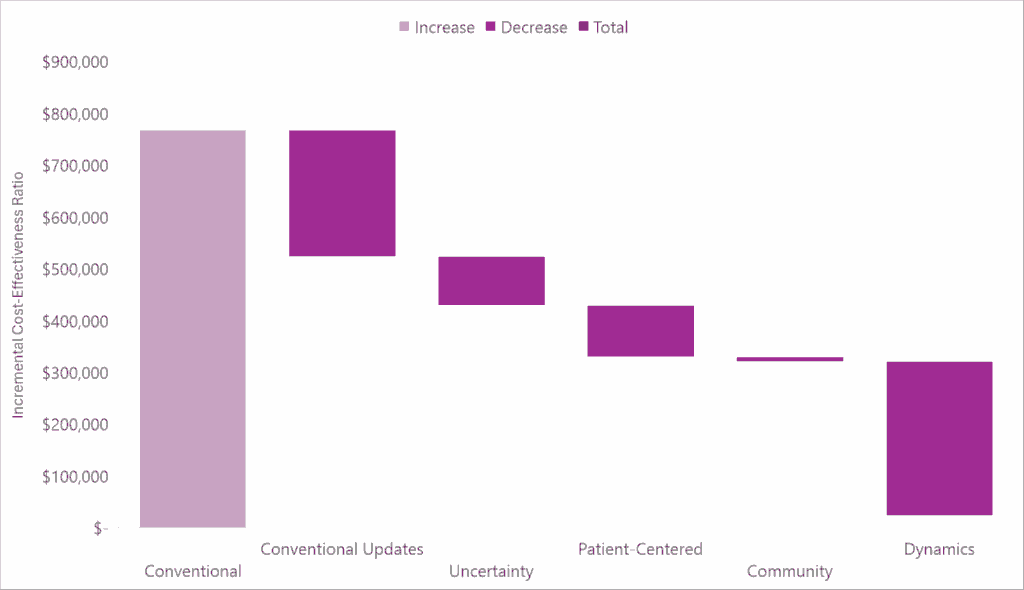

In the waterfall diagram below, we present the incremental cost-effectiveness ratio for Attruby as compared to supportive care alone using conventional cost-effectiveness analysis methods and the impact quantifying each novel domain of value has on the incremental cost-effectiveness ratio.

Check out our full report-to understand the specific impact Attruby may have on each domain of value, how it may perform under conventional and generalized cost-effectiveness analysis frameworks, and why our estimates are likely conservative.

SAD BUT TRUE

Disease-modifying therapies might not have massive benefits to the health system but that absolutely doesn’t mean that they aren’t valuable and desired by society. Disease modifying therapies are desired by patients and society because they can slow down or reverse the progression of a disease. This is often associated with life extension which is typically a desired thing we want to incentivize.

However, assessing the costs and consequences of disease modifying therapies using conventional approaches from the health system perspective is complicated because disease modifying therapies can prolong the time a person has the disease due to the life extension.

For example, in the period of baseline survival (i.e., the time the person would have been alive if they weren’t treated with a disease modifying therapy), the person treated with the disease modifying therapy typically spends more time in less severe health states. This typically translates to some cost savings in non-intervention health system costs and some improvements in quality of life during the baseline survival period. Those benefits are attributed to the treatment in conventional approaches.

However, in life extension, the person treated with the disease-modifying therapy still may progress through those more severe health states. Because they are living longer, they are also accruing more costs. The disease-modifying therapy might not prevent those costs, but rather might delay those costs or reduce some of the time spent in those more severe health states.

We saw this in the analysis for Attruby—there were non-intervention health system cost savings during the baseline survival period, but the total non-intervention health system costs were actually higher for those that received the disease-modifying therapy in the model due to the added costs in life extension.

This was also observed in a cost-effectiveness analysis for another disease-modifying therapy for ATTR-CM. The authors write: “There was no meaningful reduction in lifetime costs of cardiovascular care because savings from fewer cardiovascular hospitalizations per year were offset by increased cardiovascular costs in the added years of life”. Again, this illustrates that the benefits associated with disease-modifying therapies may largely be outside of the health system.

We suggest that more novel approaches to economic modeling may be better suited to capture society’s desire for disease-modifying therapies. This could be accomplished by 1) taking a societal perspective to capture benefits outside of the health system and value elements like option value, 2) incorporating drug dynamics to take a longer-term view on costs and to acknowledge that the intervention’s costs should only be high for a period of time, and 3) assigning equal costs and outcomes in life extension to reward all life extension equally.

SEEK AND DESTROY

The notion of incorporating future price declines is neither as academic nor as uncertain as conventional models assume. Vyndaqel®/Vyndamax® (the first disease-modifying treatment for ATTR-CM), which was approved in 2019, has already received attention from generic manufacturers. Just four years after its approval, Dexcel Pharma Technologies expressed intent to get a generic version of tafamidis approved.

The last patent for Vyndamax® expires in 2035 and thus Pfizer filed a patent infringement lawsuit against the generic manufacturer. However, the intent already expressed by Dexcel Pharma Technologies suggests future generic competition is extremely likely for these transthyretin stabilizers.

I would be remiss if I didn’t discuss the importance of intellectual property protections here. Patents and regulatory exclusivities allow for investing in healthcare innovation to make sense. It’s quite simple. These protections give exclusive rights to innovations for a finite period of time during which the innovator can charge “high” prices for that finite period of time, after which generic competition/biosimilars are free to enter and substantially drive down pricing and take away market share from the innovator.

It’s also quite simple (and scary) to understand what would happen if these protections were infringed upon. We need to ensure that during that finite period of time, intellectual property is in fact protected. During that period of time, our premium dollars go to work. And then after that finite period of time, we need to ensure that prices eventually drop. This is what Hatch-Waxman was designed to do and has made it so that 90% of filled prescriptions in the US are generics/biosimilars (up from 19% before Hatch-Waxman).

Generic/biosimilar competition after the protected period is one way to ensure prices eventually drop, but competition among branded drugs can also occur during the protected period.

Having multiple safe and effective treatment options for a condition is a win for patients and a win for society. For individual patients, one treatment option might be preferred over the other whether that be due to individual efficacy, tolerability, personal preference, etc. Having multiple options promotes finding the best option for a particular patient. For society, having multiple treatment options allows payers more power in their negotiations enabling them to “play each drug off one another, offering preferential formulary status and market share in exchange for price concessions”.

Considering Attruby, in addition to the high likelihood of a substantial price drop after the exclusivity period due to generic competition, branded competition is also possible over the protected period because both BridgeBio and Pfizer have an approved product for ATTR-CM on the market, with potentially even more competition to come from Alnylam.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.

Disclosures

The Center for Pharmacoeconomics (“CPE”) is a division of MEDACorp LLC (“MEDACorp”). CPE is committed to advancing the understanding and evaluating the economic and societal benefits of healthcare treatments in the United States. Through its thought leadership, evaluations, and advisory services, CPE supports decisions intended to improve societal outcomes. MEDACorp, an affiliate of Leerink Partners LLC (“Leerink Partners”), maintains a global network of independent healthcare professionals providing industry and market insights to Leerink Partners and its clients. The information provided by the Center for Pharmacoeconomics is intended for the sole use of the recipient, is for informational purposes only, and does not constitute investment or other advice or a recommendation or offer to buy or sell any security, product, or service. The information has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and any opinions and information contained herein are as of the date of this material, and MEDACorp does not undertake any obligation to update them. This document may not be reproduced, edited, or circulated without the express written consent of MEDACorp.

© 2025 MEDACorp LLC. All Rights Reserved.