Insights into Healthcare M&A: Q3 2024 Trends

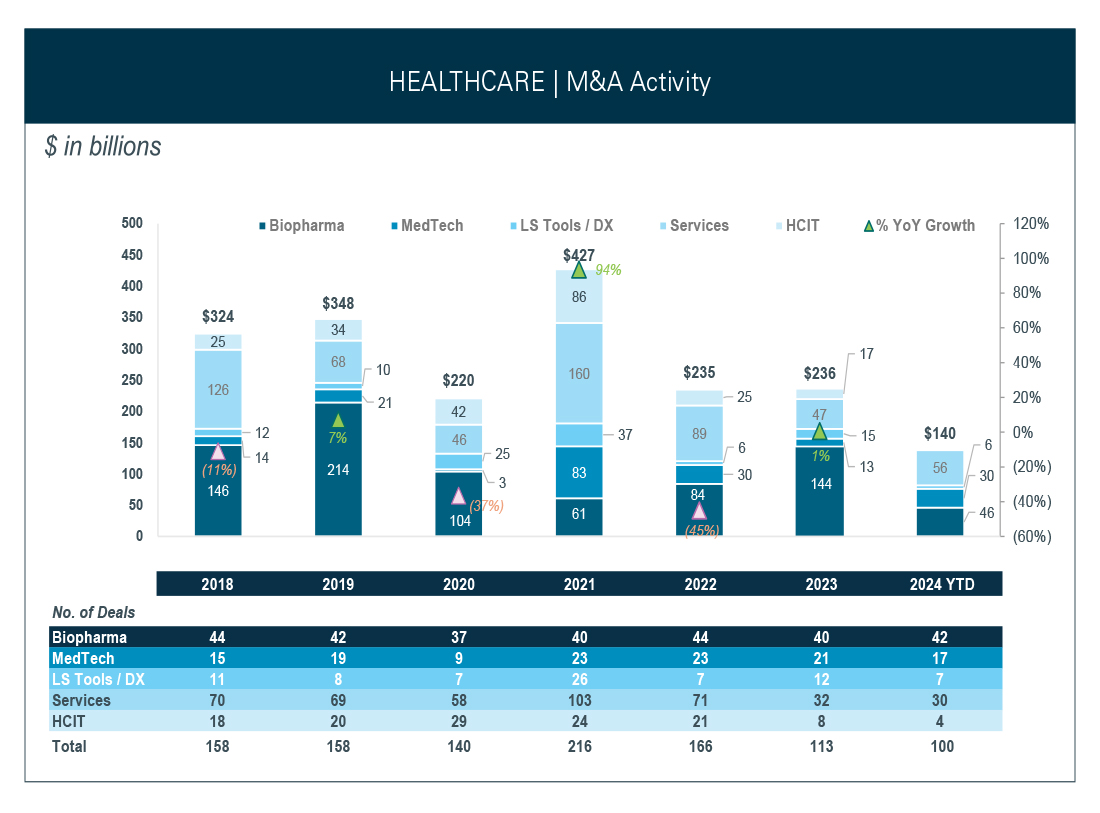

HEALTHCARE | M&A THEMES

- Healthcare M&A transaction value was up 6% and transaction volume was up 57% year-over-year in Q3 2024. Total Q3 2024 transaction value was $32B on total deal volume of 33 transactions.

- There were several multi-billion dollar Healthcare deals of note, including TowerBrook’s and CD&R’s acquisition of R1 RCM ($8.3B), Eli Lilly’s acquisition of Morphic ($3.2B), and The Carlyle Group’s acquisition of Vantive Kidney Care ($3.8B).

- Healthcare Services was the most active sub-sector of Healthcare in terms of deal volume and value. There were 14 transactions with aggregate value of $17B in Q3 2024, up from 2 transactions with aggregate value of $2 billion in Q3 2023.

- TowerBrook’s and CD&R’s $8.3B acquisition of R1 RCM accounted for 50% of the Healthcare Services deal value in Q3 2024.

- Biopharmaceuticals was the second most active sub-sector of Healthcare in terms of deal volume and value. There were 10 transactions with aggregate value of $9 billion in Q3 2024, compared to 9 transactions with aggregate value of $13 billion in Q3 2023.

- Oncology was the most active therapeutic area, with 4 transactions totaling just over $2B in deal value.

- Inflammation and Immunology was the second most active therapeutic area, with 2 transactions totaling nearly $4B in deal value.

- In MedTech, there were 5 transactions with aggregate value of $4.4B in Q3 2024, compared to 4 transactions with aggregate value of $3.6B in Q3 2023.

- The Carlyle Group’s $3.6B acquisition of Vantive Kidney Care accounted for ~85% of the MedTech deal value in Q3 2024.

HEALTHCARE | M&A ACTIVITY

3Q 2024 HEALTHCARE | M&A ACTIVITY

(2) Total Deal Value Disclosed as $1,300M.

Source: Dealogic, Scope Research, SEC filings, Company press releases. Deal inclusion criteria: Equity Value >$250 million as of 09/23/24.

BIOPHARMA | M&A THEMES

Biopharma M&A deal volume was up slightly YoY with 10 transactions in Q3 2024, compared to 9 transactions in Q3 2023. Transaction value of $9B was down 35% YoY from $13B in Q3 2023. Biogen’s $7.1B acquisition of Reata accounted for 53% of transaction value in Q3 2023.

- Acquirors signaled remained interest in oncology across varying modalities and stages of development, with Q3 2024 featuring a handful of smaller oncology deals that ranged from preclinical programs like Nerio’s novel checkpoint inhibitors to G1 Therapeutics’ COSELA, a commercial stage chemotherapy add-on designed to protect bone marrow.

- These deals represented a notable departure from large pharma acquiring late-stage clinical stage products or novel platforms with blockbuster potential.

- Exscientia / Recursion ($0.7B equity value)

- Therapeutics / Pharmacosmos ($0.4B equity value)

- Nerio / Boehinger Ingelheim (equity value not disclosed)

- For Q3 2024, Immunology & Inflammation remained an area of high interest for acquirors and Lilly’s $3.2B acquisition of Morphic was the largest Biopharma transaction in Q3 2024. Additionally, Organon entered the immune-dermatology space via their acquisition of Dermavant, which features VTAMA, a topical AhR agonist that launched in plaque psoriasis and is in registration stage for atopic dermatitis.

The XBI closed Q3 with a 7% gain and was up 10% year-to-date, though it remained 10% behind both the Nasdaq and S&P 500 year-to-date.

- Follow-on activity slowed in Q3, though remains on pace for a record-breaking year. $6.7 billion of capital was raised across 24 registered offerings and 7 PIPEs. Aftermarket performance for these transactions has been largely positive.

- There was an uptick in go-public activity with $1.2 billion of capital raised from five IPOs and the closing of the Tectonic Therapeutics and AvroBio reverse merger.

As stated in our Q2 M&A update, we expect biopharma M&A to remain active through the remainder of 2024. With the recent 50 basis point cut to the federal funds rate and a dovish outlook, we expect both public and private biopharma companies to benefit from a favorable macro environment. As we have mentioned in prior quarterly market updates, we continue to expect high-quality privately held biotechnology companies to evaluate sale transactions in parallel to assessing the public markets as an alternative exit for investors. We expect distressed publicly traded companies to continue to pursue private company mergers or cash-out transactions with financial buyers. On the demand side, large biopharma continues to face impending revenue gaps due to anticipated patent expiries and will continue targeting commercial stage or clinically de-risked companies targeting large commercial markets. Larger transactions are possible, but given the upcoming election and continued FTC uncertainty, large biopharma will remain hesitant to pursue mega deals. We expect to see continued robust activity away from the mega deals.

3Q 2024 BIOPHARMA | M&A ACTIVITY

(2) Total Deal Value Disclosed as $1,300M.

Source: Dealogic, Scope Research, SEC filings, Company press releases. Deal inclusion criteria: Equity Value >$250 million as of 09/23/24.

Disclosures

This information (including, but not limited to, prices, quotes, and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and the information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. The information is not an offer to sell or a solicitation to buy any product to which this information relates. Leerink Partners LLC (“Firm”), its officers, directors, employees, proprietary accounts, and affiliates may have a position, long or short, in the securities referred to in this report, and/or other related securities, and from time to time may increase or decrease the position or express a view that is contrary to that contained in this piece. The Firm’s research analysts, bankers, salespeople, and traders may provide oral or written market commentary or trading strategies that are contrary to opinions expressed, and the Firm’s market making desk may make investment decisions that are inconsistent with the opinions expressed in this document. The past performance of securities does not guarantee or predict future performance. This material does not take into account individual circumstances, objectives, or needs and is not intended as a recommendation to any particular person(s). As such, the financial instruments discussed herein may not be suitable for all investors, and investors must make their own investment decisions based upon their specific investment objectives and financial situation. This material is a marketing communication and is not and should not be construed as investment research or a research report prepared by a research analyst. Any views portrayed in this material may differ from those of the research department of Leerink Partners LLC. All information contained herein is intended solely for your own personal, informational use, and you are not permitted to reproduce, retransmit, disseminate, sell, license, distribute, republish, broadcast, post, circulate or commercially exploit the information in any manner or media without the express written consent of Leerink Partners LLC, or to use the information for any unlawful purpose. Additional information is available upon request by contacting the Editorial Department, Leerink Partners LLC, 53 State Street, 40th Floor, Boston, MA 02109. MEDACorp LLC (MEDACorp), an affiliate of Leerink Partners LLC, is a global network of independent healthcare professionals (Key Opinion Leaders and consultants) providing industry and market insights to Leerink Partners and its clients. © 2026 Leerink Partners LLC. All Rights Reserved. Member FINRA/SIPC.

Disclosures

This information (including, but not limited to, prices, quotes, and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and the information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. The information is not an offer to sell or a solicitation to buy any product to which this information relates. Leerink Partners LLC (“Firm”), its officers, directors, employees, proprietary accounts, and affiliates may have a position, long or short, in the securities referred to in this report, and/or other related securities, and from time to time may increase or decrease the position or express a view that is contrary to that contained in this piece. The Firm’s research analysts, bankers, salespeople, and traders may provide oral or written market commentary or trading strategies that are contrary to opinions expressed, and the Firm’s market making desk may make investment decisions that are inconsistent with the opinions expressed in this document. The past performance of securities does not guarantee or predict future performance. This material does not take into account individual circumstances, objectives, or needs and is not intended as a recommendation to any particular person(s). As such, the financial instruments discussed herein may not be suitable for all investors, and investors must make their own investment decisions based upon their specific investment objectives and financial situation. This material is a marketing communication and is not and should not be construed as investment research or a research report prepared by a research analyst. Any views portrayed in this material may differ from those of the research department of Leerink Partners LLC. All information contained herein is intended solely for your own personal, informational use, and you are not permitted to reproduce, retransmit, disseminate, sell, license, distribute, republish, broadcast, post, circulate or commercially exploit the information in any manner or media without the express written consent of Leerink Partners LLC, or to use the information for any unlawful purpose. Additional information is available upon request by contacting the Editorial Department, Leerink Partners LLC, 53 State Street, 40th Floor, Boston, MA 02109. MEDACorp LLC (MEDACorp), an affiliate of Leerink Partners LLC, is a global network of independent healthcare professionals (Key Opinion Leaders and consultants) providing industry and market insights to Leerink Partners and its clients. © 2026 Leerink Partners LLC. All Rights Reserved. Member FINRA/SIPC.

Disclosures

This information (including, but not limited to, prices, quotes, and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice, and the information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. The information is not an offer to sell or a solicitation to buy any product to which this information relates. Leerink Partners LLC (“Firm”), its officers, directors, employees, proprietary accounts, and affiliates may have a position, long or short, in the securities referred to in this report, and/or other related securities, and from time to time may increase or decrease the position or express a view that is contrary to that contained in this piece. The Firm’s research analysts, bankers, salespeople, and traders may provide oral or written market commentary or trading strategies that are contrary to opinions expressed, and the Firm’s market making desk may make investment decisions that are inconsistent with the opinions expressed in this document. The past performance of securities does not guarantee or predict future performance. This material does not take into account individual circumstances, objectives, or needs and is not intended as a recommendation to any particular person(s). As such, the financial instruments discussed herein may not be suitable for all investors, and investors must make their own investment decisions based upon their specific investment objectives and financial situation. This material is a marketing communication and is not and should not be construed as investment research or a research report prepared by a research analyst. Any views portrayed in this material may differ from those of the research department of Leerink Partners LLC. All information contained herein is intended solely for your own personal, informational use, and you are not permitted to reproduce, retransmit, disseminate, sell, license, distribute, republish, broadcast, post, circulate or commercially exploit the information in any manner or media without the express written consent of Leerink Partners LLC, or to use the information for any unlawful purpose. Additional information is available upon request by contacting the Editorial Department, Leerink Partners LLC, 53 State Street, 40th Floor, Boston, MA 02109. MEDACorp LLC (MEDACorp), an affiliate of Leerink Partners LLC, is a global network of independent healthcare professionals (Key Opinion Leaders and consultants) providing industry and market insights to Leerink Partners and its clients. © 2026 Leerink Partners LLC. All Rights Reserved. Member FINRA/SIPC.